Current Rates And Funding

We strive to provide high-quality early childhood education at affordable rates. Our current tuition rates are designed to fit various family budgets, and we offer several funding options.

Current rates and funding schemes

Rates

Our current rates are set at £6 per hour for academic year 2024/2025. This will change to £7 an hour from September 2025.

The funding can be completed and we are happy to assist you in navigating the various funding schemes available. A brief description of each funding scheme and some helpful links are set out below.

FEEE2

Free Early Education Entitlement for 2 year-olds - 15 hours per week

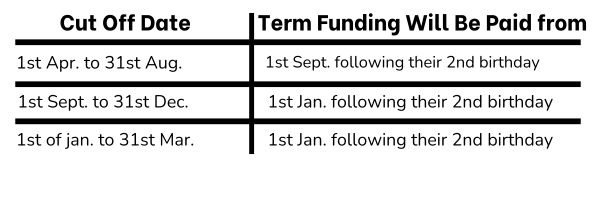

From September 2014 the law changed to allow more two-year-olds to benefit from free childcare. As we have an Ofsted rating of Good we are able to claim funding for eligible two-year-olds. A child can access the funding in the term following their 2nd birthday, see below:

The FEEE for two-year-olds is not a universal offer, only eligible children may access this funding via an application process. Families can apply for funding online, or through a childcare provider, Family Hub, health visitor, social worker or specialist teacher. To apply online parents/carers should go to the:

You need to Log in and click on ‘Funded Early Education for Two-Year-Olds’ to complete an application. Once the application is submitted eligibility will be checked and if eligible you will be given a reference number which will allow us to access the funding.

FEEE3-4

Free Early Education Entitlement for 3 to 4 -year-olds – 15 hours per week

The Free Entitlement is a government programme giving all 3 – 4-year-olds up to a maximum of 15 hours of free education/childcare per week. This is calculated over a maximum of 38 weeks, equivalent to 570 hours per year. A child can access the funding in the term following their 3rd birthday, see below:

The dates have been fixed by DfE in line with the current Statutory Guidance Free Entitlement funding comes from central government to the local authority, who then set the funding rates and make payments to providers. We will ask Parents/Carers to sign a ‘Parent Agreement Form’ each term and arrange the funding on your behalf. No direct payments are ever made to parents.

Working Parents

30 hours funding/Extended Entitlement for working parents of 3 to 4 year olds

The Government has introduced a new scheme for working parents commencing on 1 September 2017. This is referred to as the ’30 hours scheme’ or ‘Extended Entitlement’. This entitles working parents of 3 to 4 year olds up to 30 hours of free funding.

Children aged 3 to 4 are already entitled to the universal 15 hours (as detailed above).

If you believe you are eligible you need to apply through the GOV website:

www.childcarechoices.gov.uk

Eligible families will be given an 11 digit code which you pass to us to be validated (together with your NI number) and then we can access the funding. Without this code we cannot access the extended entitlement funding. You will need to have registered for the extended entitlement and have your eligibility code before the start of the term to access the funding in that term as follows:-

If you miss this deadline, you will not be able to claim the extended entitlement funding until the next term, and will have to pay the fees for the extra hours.

If you have any questions regarding the funding available contact Angela Taylor on 07456332238 or admin@dhcps.co.uk.

EYPP

Early Years Pupil Premium

There is additional funding for early years settings to improve the education they provide for disadvantaged 3- and 4-year-olds. 3- and 4-year-olds in state-funded early education will attract EYPP funding if they meet at least 1 of the following criteria:

If your family gets 1 of the following, please speak to Angela Taylor to discuss the Pre-School being able to claim the additional funding and how it will be best used to support your child:

• Income support,

• Income-based Jobseeker’s Allowance,

• Income-related Employment and Support Allowance support under part VI of the Immigration and Asylum Act 1999,

• The guaranteed element of State Pension,

• Credit Child Tax Credit (provided they’re not also entitled to Working Tax Credit and have an annual gross income of no more than £16,190),

• Working Tax Credit run-on, which is paid for 4 weeks after they stop qualifying for Working Tax Credit Universal Credit,

• They are currently being looked after by a local authority in England or Wales, they have left care in England or Wales through: an adoption a special guardianship order a child arrangement order,

•Children must receive free early education in order to attract EYPP funding.

For further information click on the link below:

More than just a joyful place

If you have any questions or concerns feel free to contact us below